Generally, you’re able to send wire transfers to people with accounts at other banks. Before diving into all things crypto, Zak contributed to Finder’s money transfers vertical. Zak’s focus is in breaking down technical concepts into approachable nuggets of information. He’s mined and minted cryptocurrencies, and remembers the days when DOGE was just for fun. He has an MBA from the University of Colorado, and has worked for credit unions and large financial firms, in addition to writing about personal finance for more than two decades. He covers banking, loans, investing, mortgages, and more for The Balance. Justin Pritchard, CFP, is a fee-only advisor and an expert on personal finance. Fees are often lower to receive a wire transfer than to send one ($30 and up), and foreign transfers are more costly than domestic ones. To do so, speak with somebody at your bank to find out if the funds have “cleared,” and discuss any concerns you have about the transaction.

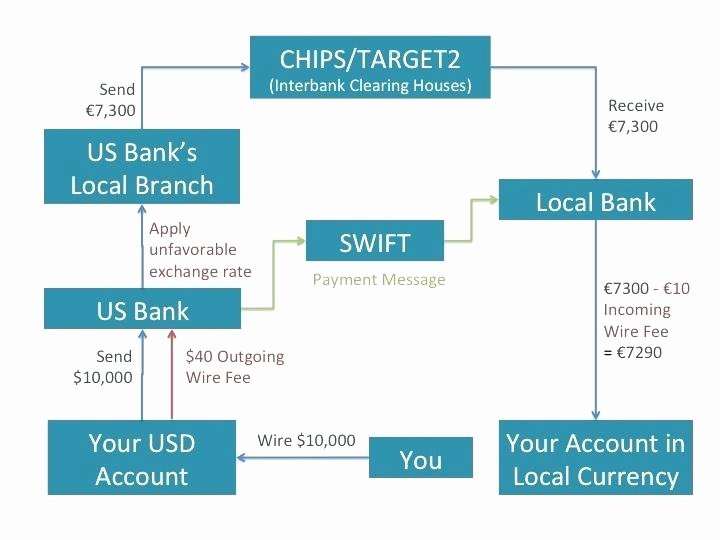

Some banks charge incoming wire transfer fees, which might be waived depending on the type of account held at the bank. Your bank may offer Zelle or people use apps and services such as PayPal, Venmo and Wise. These days, wire transfers aren’t the only fast way to send or transfer money. This guide will help you understand the process of receiving an incoming international wire transfer to a US bank account. The recipient will be notified when the funds are available, so will need to check their account regularly. For bank-to-bank transfers, you will need to register for online banking to be able to track the payment progress. JPMorgan Chase Sitesīeing able to track your bank wire transfer can give you peace of mind that the recipient has received the funds. The tracer will show how and when the transfer was processed between sending, receiving, and intermediary banks, and, most importantly, where it is now. You may also incur returned item fees if you are charged an overdraft feeon a check written against insufficient funds in your account. You’ll pay $34 for each overdraft transaction-when you spend more than what’s available in your account. Wiring money to an overseas account is fairly easy and can be done online or in person at a bank or a money transfer service office. A typical wire transfer can be completed in a branch with a banker, on the phone, or through online banking. Typically, wire transfers are not allowed through certificate of deposit accounts. financial institutions to make wire transfers available to recipients within one business day. The Expedited Funds Availability Act requires U.S.Depending on the banks that both the sender and the recipient use, it’s possible to initiate a wire transfer via the bank itself.To complete this transfer, you usually need the name of the recipient, their bank name, account number, and pickup details.SWIFT/BIC codes globally identify banks and financial institutions.Some banks have several daily cut-off times for wire transfers and send multiple daily batches. CHIPS) for net settlement, which processes multiple transactions as part of a batch process. Every year, over $500 billion is transferred between countries across the globe through secure international wire transfers. Where a domestic money transfer usually takes a few minutes, an international money transfer - also known as a “remittance” - may take a few days or sometimes longer. The amount of time it takes to wire money abroad depends on where it’s being sent. If you begin a wire transfer but change your mind about sending someone money, you may be able to cancel the transaction.

Online banks are more likely to offer the highest rates to boost your savings.

0 kommentar(er)

0 kommentar(er)